Navigating through the complex maze of the Payment Card Industry Data Security Standard (PCI-DSS) compliance is already a daunting task for businesses. But when you’re tasked with maintaining this arduous compliance across multiple locations, the challenge intensifies exponentially. “Overcoming Challenges in Maintaining PCI-DSS Compliance across Multiple Locations” provides you with practical insights and strategies to streamline this process and ensure consistent compliance across all your business locations. This expert guidance aids you in mitigating potential risks, sustaining your business integrity, and most importantly, staving off expensive non-compliance penalties. You’ll find that overcoming these challenges is not insurmountable, but rather, it’s a strategic move that safeguards your business resilience and growth.

Understanding PCI-DSS Compliance

Defining PCI-DSS compliance

Payment Card Industry Data Security Standard (PCI-DSS) is a set of security standards designed to ensure that all companies that accept, process, store or transmit credit card information maintain a secure environment. It is a universal standard that applies to any business that handles cardholder data.

The importance of PCI-DSS compliance for businesses

PCI-DSS compliance serves as a critical keystone in safeguarding businesses and their customer data. Through adherence to these standards, businesses fortify their defenses against data breaches, theft, and fraudulent activities. Achieving PCI-DSS compliance portrays a company as trustworthy, enhancing its reputation amongst clients and partners. Failure to comply, however, can result in severe penalties, financial losses, and damage to brand image.

Understanding the 12 requirements of PCI-DSS compliance

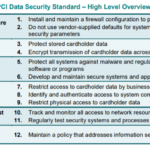

The 12 requirements of PCI-DSS compliance form a comprehensive guideline for best practices in cardholder data security. These include protecting cardholder data, maintaining a secure network, managing vulnerabilities, implementing strong access control measures, regularly monitoring and testing networks and maintaining an information security policy. Each requirement plays a vital role in forming a watertight security structure.

Challenges of Maintaining PCI-DSS Compliance

Inconsistency in security measures across different locations

Maintaining consistency in security measures across varied locations is a considerable challenge. Discrepancies can arise due to different local regulations, cultural differences, and operational variations. Such inconsistencies can create loopholes in security, making it difficult to sustain PCI-DSS compliance.

Difficulty in managing multiple service providers

For organizations working with various service providers, managing compliance can be complex. Different providers may have distinct compliance controls and security measures, which can complicate the process of ensuring uniform compliance standards.

Challenges around data storage and retrieval

Storing and retrieving data securely while ensuring quick accessibility when required pose significant challenges. Businesses need efficient systems and process for securely managing the lifecycle of cardholder data to stay in line with PCI-DSS standards.

Technical issues and outdated systems

Outdated systems and technology can hinder compliance with PCI-DSS standards. As threats evolve, so should a company’s defenses – this often includes regularly updating systems or replacing them with more secure alternatives.

Staff training and awareness

The role that staff play in maintaining a secure environment can’t be understated. Without proper training and awareness, employees can inadvertently compromise the system’s security, causing severe breaches.

Strategies for Overcoming Compliance Challenges

Creating a unified security strategy

A unified security strategy that aligns all security procedures will ensure consistent security measures across multiple locations. It reduces complexity, enhances visibility, improves control, and helps overcome many compliance challenges.

Implementing centralized data management

Centralized data management can simplify the process of meeting compliance obligations. It provides increased transparency and allows for better control over the storage, retrieval and disposal of sensitive cardholder data.

Investing in up-to-date security technologies

Modern, up-to-date security technologies can effectively address many of the technical issues that may otherwise impede compliance. Such investments are critical in maintaining a sturdy defense mechanism that meets PCI-DSS requirements.

Strengthening staff training and education programs

A robust staff training program aimed at enhancing awareness of security protocols and PCI-DSS standards can contribute immensely to overcoming compliance challenges. An educated team member is the first line of defense against security breaches.

Consistency in Security Measures

Importance of security measure consistency

Uniform security measures are key to ensure a robust defense against potential breaches across multiple locations. It minimizes vulnerabilities and ensures a cohesive security strategy aligned with PCI-DSS standards.

Ways to ensure consistency

Companies can ensure consistency by implementing standardized protocols, leveraging unified security platforms and conducting regular audits. Continuous monitoring and evaluation also help identify and rectify any inconsistencies promptly.

Tools for monitoring and maintaining consistency

various tools, such as compliance management software, can help monitor and maintain consistent security measures across multiple locations. These tools provide real-time visibility into the compliance status and aid in detecting and correcting any discrepancies swiftly.

Managing Multiple Service Providers

Significance of managing multiple service providers effectively

Effective management of multiple service providers is crucial in maintaining PCI-DSS compliance. Since each provider might have different security protocols, managing them individually without compromising overall security can be challenging.

Challenges related to different service providers

Each service provider’s unique security measures, conflicting protocols, non-uniformity in compliance standards, and lack of centralized control are some challenges associated with managing multiple service providers.

How to streamline processes with various service providers

To streamline processes, it’s essential to establish clear communication channels, standardize security protocols as much as possible, and regularly monitor all providers for compliance. Collaboration and continuous dialogue can greatly help in overcoming the challenges associated with multiple service providers.

Handling Data Storage Issues

Common data storage issues

Data storage issues such as unorganized storage practices, lack of access controls, insufficient encryption, or data stored past its necessary period can pose serious threats to PCI-DSS compliance.

Effect on PCI-DSS compliance

Failure to properly store and manage data can lead to non-compliance with PCI-DSS standards and result in potential data breaches, financial penalties, and damage to reputation.

Solutions for effective data storage

Implementing strong encryption for stored data, deploying robust access control mechanisms, and maintaining stringent data retention policies can help overcome data storage issues. Investing in secure data storage solutions and conducting regular audits can ensure ongoing compliance with PCI-DSS standards.

Dealing with Technical Issues and Outdated Systems

Major technical issues and their impact on PCI-DSS compliance

Technical glitches, software vulnerabilities, outdated systems, and inefficient security measures are some of the technical issues that can impact PCI-DSS compliance.

Effects of outdated systems

Outdated systems often have unpatched security gaps that are easy to exploit, making them a significant risk to data security. They can also be incompatible with newer, more secure technologies and can cause non-compliance with the evolving PCI-DSS standards.

Best practices to overcome these challenges

Regular system updates, timely patching of software vulnerabilities, and replacing outmoded systems with up-to-date technologies are some of the best practices to overcome these challenges. It’s also important to continually evaluate and adapt security measures in response to emerging threats.

Staff Training and Awareness

Importance of staff awareness regarding PCI-DSS compliance

Staff training and awareness are integral components in maintaining PCI-DSS compliance. Employees play a significant role in safeguarding sensitive data, and their actions can either fortify or weaken a company’s security.

Best methods to train staff

Periodic training programs and workshops, simulated security drills, and regularly updated training materials are great ways to educate staff. Keeping them informed about the latest threats and defenses can enhance their vigilance and commitment to security.

Monitoring employee adherence to compliance

Implementing measures for monitoring employee adherence to compliance regulations is as crucial as the training itself. Regular audits, real-time monitoring, and enforcing accountability can help ensure that all staff members adhere to the set security standards.

Implementing Compliance Audit and Monitoring

Reasons to conduct regular compliance audits

Conducting regular compliance audits helps identify any deviations from the PCI-DSS standards and rectify them promptly. Audits ensure accountability, verify compliance, and provide valuable insights to enhance security mechanisms.

Audit best practices

Regular audits should be thorough, covering all aspects of PCI-DSS standards. Documentation of audit findings, prompt follow-up actions, and conducting audits at regular intervals are some of the best practices to ensure effective audits.

Utilizing audit findings for improved compliance

Data derived from audits should be analyzed and used to improve security measures, rectify non-compliance, and enhance staff training programs. This proactive approach can significantly improve overall compliance strategies.

Incorporating Technology for Better Compliance

Role of technology in ensuring PCI-DSS compliance

Technology plays a pivotal role in ensuring PCI-DSS compliance. From encryption and firewalls to access controls and intrusion detection systems, technology forms the backbone of the security measures required for PCI-DSS standards.

Choosing the right compliance tools

Choosing the right compliance tools should be based on their alignment with the company’s security needs, compatibility with existing systems, scalability, and ability to meet the PCI-DSS standards effectively.

Using technology to simplify compliance management across multiple locations

With the right technology, companies can simplify compliance management across multiple locations. Compliance software solutions that provide real-time monitoring, instant alerts, and unified control can streamline compliance management and significantly reduce the complexities associated with maintaining PCI-DSS compliance across multiple locations.