As you navigate through the complexities of maintaining data security in your business, understanding the integration of PCI-DSS compliance with other compliance standards such as GDPR becomes an essential part of your cybersecurity strategy. This article aims to offer clarity on how to merge these seemingly separate entities successfully, and presents practical strategies to streamline your data protection efforts to ensure both secure transactions, and respect for your clients’ personal information in accordance with global data privacy laws.

This image is property of www.cyborgenic.com.

Understanding PCI-DSS Compliance

Definition and importance of PCI-DSS compliance

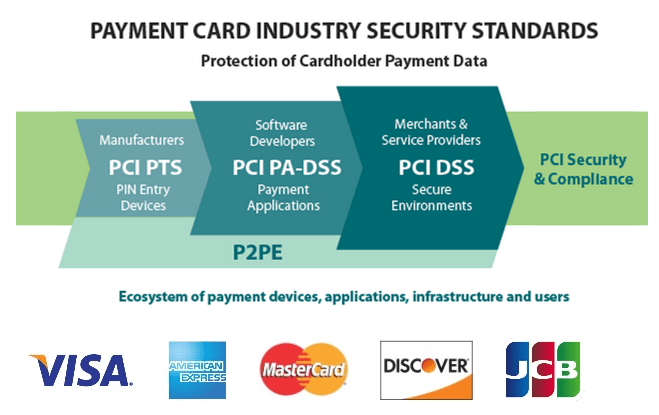

PCI-DSS stands for Payment Card Industry Data Security Standard. It is a set of security standards that are crafted to ensure that all companies accepting, processing, storing, or transmitting credit card information maintain a secure environment. The compliance to PCI-DSS is not an optional practice; it is an obligation for organizations that handle credit card transactions. Its significance lies in the protection it offers to cardholders from data breaches and theft of card data, thereby fostering trust between businesses and their customers.

Components of PCI-DSS compliance

PCI-DSS Compliance is comprised of 12 key requirements organized into six categories, encompassing security measures regarding firewalls, data encryption, user access management, and network monitoring, among other aspects. These components aim to ensure secure management of cardholder data, defend against network vulnerabilities, install strong access control measures, and maintain an information security policy.

Benefits of PCI-DSS compliance for businesses

Adhering to PCI-DSS standards has immense benefits for businesses. The most notable benefit is the provision of a secure business environment which engenders trust among customers. Additionally, it helps to prevent financial losses that could result from data breaches and protects the reputation of the business, which could significantly be damaged by such breaches. On a broader level, PCI-DSS compliance enhances the overall payment card industry by ensuring that transactions are secure and reliable.

Challenges in achieving and maintaining PCI-DSS compliance

While PCI-DSS Compliance is crucial, it is not without challenges. The complexity of the standards compels businesses to invest significant resources in maintaining compliance. The dynamic nature of digital threats requires continuous monitoring and regular updates to security controls, which might be resource-intensive. Identifying and managing cardholder data can also be a daunting task, especially for large organizations.

Exploring GDPR Compliance

Overview of GDPR compliance

GDPR, or General Data Protection Regulation, is a regulation initiated by the European Union (EU) to govern data security and privacy for all individuals within the EU and the European Economic Area. Compliance to GDPR is mandatory for all businesses operating within these regions. It aims to give individuals control over their personal data and to unify the data protection laws within the region.

Major aspects of GDPR

GDPR compliance revolves around several core principles. These include lawfulness, where personal data should be processed fairly, transparently, and with a legitimate basis; purpose limitation, where personal data should only be collected for explicit and legitimate purposes; and data minimization, where personal data collected should be adequate, relevant, and limited to what is necessary for the proposed purposes.

Consequences of non-compliance with GDPR

Non-compliance with GDPR can lead to severe consequences in the form of penalties. Depending on the severity of non-compliance, organizations can incur fines of up to €20 million or 4% of their annual global turnover, whichever is higher. Beyond financial penalties, non-compliance can damage business credibility and consumer trust.

Factors promoting successful GDPR compliance integration

Integration of GDPR compliance into a business requires comprehensive planning and commitment. Employing a Data Protection Officer, conducting regular audits and assessments, upholding individual’s rights, and incorporating privacy-by-design into the business processes are some of the strategic factors that promote successful GDPR compliance integration.

Core Differences between PCI-DSS and GDPR

Comparison on the basis of objectives

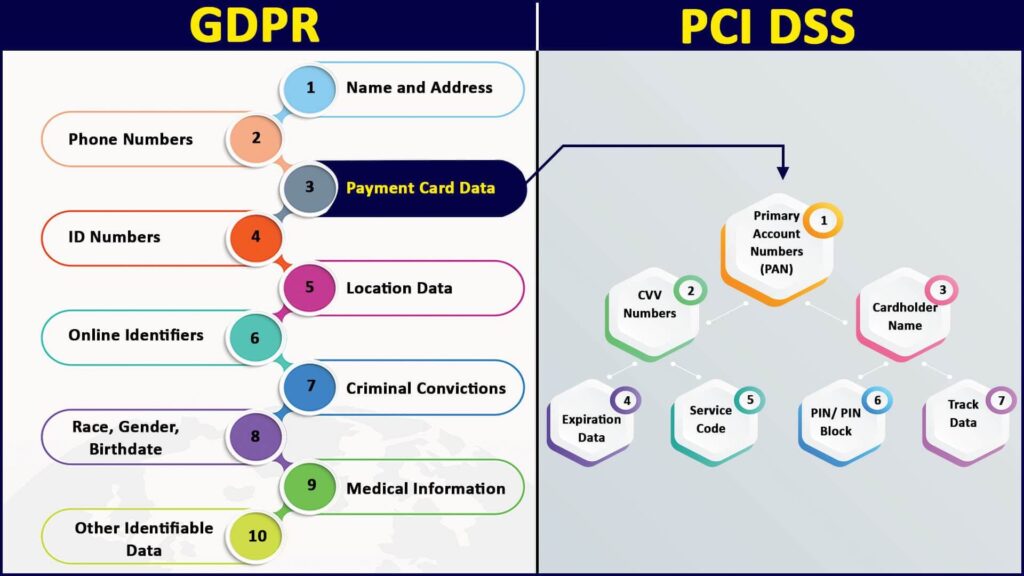

While both PCI-DSS and GDPR are aimed at improving data protection, they differ significantly in their objectives. PCI-DSS is specifically designed to protect cardholder data for transactions involving payment cards, while GDPR focuses on the protection of General personal data of EU citizens.

Differences in the compliance requirements

The compliance requirements for the two standards also differ. For instance, PCI-DSS has 12 specific requirements spanning a limited scope of payment card data. On the other hand, GDPR does not have specific requirements but enforces seven principles that must be adhered to for all personal data, implicating a diverse range of business operations and procedures.

Comparison of the enforcement mechanisms

Both compliance standards are enforced differently. PCI-DSS is maintained by the PCI Security Standards Council which enforces compliance by conducting compliance tests, while GDPR is governed by regulatory authorities in each EU and EEA country, which have the power to impose fines for GDPR breaches.

Handling data breaches under PCI-DSS and GDPR

In the unfortunate event of a data breach, both PCI-DSS and GDPR set out different guidelines for businesses. Under PCI-DSS, businesses are required to report the breach to the card companies, whereas under GDPR, businesses are obliged to report any data breaches to the relevant supervisory authority within 72 hours of becoming aware of the breach.

Similarities between PCI-DSS and GDPR

Shared focuses – Protection of sensitive data

Both PCI-DSS and GDPR share a common focus on protecting sensitive data. While PCI-DSS is concerned with cardholder data, GDPR encompasses a broader range of personal data but with the same objective to protect individuals’ privacy and security.

Requirement of continual monitoring

Continual monitoring of data and security measures is a shared requirement by both standards. This is essential to ensure that the set principles and requirements are adhered to at all times, mitigating any potential threats or breaches.

Penalties for non-compliance

Non-compliance with either PCI-DSS or GDPR can result in severe financial penalties for businesses. These penalties not only serve as a deterrent for potential non-compliance but also emphasize the importance of data protection for both standards.

The concept of accountability

Both PCI-DSS and GDPR place a strong emphasis on the concept of accountability. Businesses are held responsible for protecting the sensitive data they handle, promoting an atmosphere of diligence and integrity in data protection.

This image is property of www.vistainfosec.com.

Why Integrate PCI-DSS and GDPR

Efficiency in managing data security

An integrated compliance approach combines the benefits of both PCI-DSS and GDPR, leading to more comprehensive and efficient management of data security. This approach eliminates the potential for overlap and contradiction in compliance efforts, simplifying the overall data protection process.

Reduction of potential legal ramifications

Integrating PCI-DSS and GDPR reduces the potential for businesses facing legal ramifications due to non-compliance. This is particularly significant as potential fines under both standards can be crippling.

Enhanced customer trust

With an integrated approach to data protection, businesses demonstrate their commitment to handling client data responsibly and securely, enhancing customer trust and loyalty.

Potential cost savings

While implementing an integrated compliance approach may require significant investment initially, it can lead to substantial cost savings in the long run by reducing the risk of penalties and the efficiency of resource usage.

Challenges in Integrating PCI-DSS with GDPR

Difference in scope

The scope of both standards differs substantially, making integration a challenge. While PCI-DSS is specific to cardholder data, GDPR is much broader, covering all personal data. It means the scope of data protection measures under GDPR goes beyond PCI-DSS’s regulatory reach.

Complexity in process integration

The processes required for compliance with both standards can also be complex to integrate. Each standard necessitates various procedures and controls, from internal security measures to data reporting, making the integration process challenging to implement and maintain.

Resource allocation

Resource allocation can be a significant challenge when integrating these two standards. The process may require additional personnel, infrastructure, and technology, which can be costly. Managing these resources effectively is a critical aspect to ensure successful integration.

Understanding the nuances of both standards

The intricacies of both PCI-DSS and GDPR necessitate a deep understanding of each standard. The guidelines for each differ and require expertise to navigate, making an adequate understanding a prerequisite for successful integration.

This image is property of pii-tools.com.

Strategies for Effective Integration of PCI-DSS and GDPR

Creating a joint compliance team

One effective strategy is to form a joint compliance team. This team would be responsible for understanding the requirements of both standards, spotting overlaps and contradictions, and developing a cohesive plan to achieve compliance with both standards.

Developing combined compliance procedures

Creating combined sets of procedures that adhere to both PCI-DSS and GDPR is another effective strategy. This should include aspects of data collection, storage, processing, and deletion, among others. It would ensure all procedures are both PCI-DSS and GDPR compliant.

Utilising the right technology

Appropriate use of technology is essential in effectively integrating PCI-DSS and GDPR. This could include secure data storage and processing technologies, encryption and tokenization, and automated systems for compliance monitoring and reporting.

Continuous monitoring and adjustments

Like all compliance processes, constant monitoring and periodic adjustments are crucial. This ensures compliance with both standards at all times and allows businesses to quickly identify and rectify any potential issues.

Case Study: Successful Integration of PCI-DSS and GDPR

Objective of the study

The objective here is to describe a case where a business successfully integrated PCI-DSS and GDPR compliance. This case study serves as an insightful reference point to understanding practical issues and beneficial strategies employed for successful integration.

Approach used

The business began by forming a joint compliance team. The team identified overlaps and conflicts between the two standards and developed a plan for combined compliance. The plan covered all aspects of data handling and included the use of technology for data protection and compliance monitoring.

Obstacles encountered and solutions adopted

The business faced challenges in understanding and applying the nuances of both standards. To overcome this, they hired external consultants specializing in both PCI-DSS and GDPR compliance. They also encountered difficulty in resource allocation, which they addressed by reallocating resources based on the priority of compliance tasks.

Lessons learnt

From this case study, it’s clear that understanding both standards, careful planning, effective resource allocation, and continuous monitoring are crucial for successfully integrating PCI-DSS and GDPR compliance.

This image is property of www.atlantic.net.

The Role of Technology in Integrating PCI-DSS and GDPR

Use of data mapping tools

Data mapping tools play a vital role in achieving compliance, enabling businesses to identify where personal and cardholder data resides, who has access to it, and how it is being protected.

Automation of compliance processes

Automating compliance processes, such as data protection controls and compliance reports, can significantly ease the integration of PCI-DSS and GDPR. Automated systems can provide a level of consistency and accuracy that manual processes often struggle to achieve.

Role of encryption and tokenization

Technologies like encryption and tokenization are critical in protecting sensitive data, whether it falls under the scope of PCI-DSS, GDPR, or both. These tools offer robust security measures to keep sensitive data secure.

Importance of effective reporting tools

Effective reporting tools can simplify the recording, tracking, and communication of compliance efforts. These tools can automate the creation of compliance reports, easing the reporting burden on businesses and improving transparency in compliance efforts.

Future of Compliance Standards Integration

Predicted compliance trends

In the future, integrated compliance approaches are expected to become more popular, driven by increased regulations and heightened awareness of data protection. The trend towards digital transformation will also mean that businesses will need to adapt compliance efforts to suit a digital age.

Impact of emerging technologies on compliance

Emerging technologies, such as artificial intelligence, blockchain and advanced analytics, are expected to shape the future of compliance. These technologies could automate compliance procedures, enhance data protection, and provide more effective monitoring and reporting.

Possible evolution of PCI-DSS and GDPR

Both PCI-DSS and GDPR standards could evolve to address developing threats and changes in the technology landscape. This could include expanded scope, increased fines, and new principles to govern emerging technologies.

Preparation for future changes in compliance standards

Businesses should monitor the evolving landscape of compliance standards and be prepared to adapt compliance efforts accordingly. Continuous learning, regular audits, and a proactive approach towards compliance are critical in being prepared for future changes.