“Exploring the Tools and Resources Available to Aid in PCI-DSS Compliance” is a transformative article designed to illuminate the path towards achieving Payment Card Industry Data Security Standard (PCI-DSS) compliance. Navigating this regulatory environment can be labyrinthine without a solid understanding of the plethora of tools and resources available at your disposal. This carefully curated guide will not only equip you with the necessary knowledge to identify and utilize these aids effectively but also assist in minimizing risk and ensuring the safety of cardholder data. Therefore, augmenting both your understanding and confidence when dealing with PCI-DSS compliance.

Understanding PCI-DSS Compliance

With the ever-rising incidents of cybercrime and data breaches, it’s becoming increasingly essential for organizations to safeguard their customers’ payment card info. In this day and age, adhering to the standards set by Payment Card Industry Data Security Standard (PCI-DSS) is a significant part of card information protection.

Definition and Importance of PCI-DSS

The Payment Card Industry Data Security Standard (PCI-DSS) is a universally recognized set of rules and procedures meant to optimize the security of card transactions and safeguard cardholders against fraud. Any organization that accepts, processes, stores or transmits card information needs to adhere to these standards. PCI-DSS is vital as it protects both the businesses and customers, enhancing trust and client retention.

Benefits of PCI-DSS Compliance

Being compliant with PCI-DSS offers numerous benefits. First, it safeguards sensitive cardholder data, reducing the chances of a data breach. Secondly, it promotes trust among clients by demonstrating a commitment to secure transactions. Thirdly, PCI-DSS compliance helps nurture good relations with payment card brands. Lastly, complying with these standards mitigates the costly repercussions of non-compliance like fines, legal issues, damaged reputation, and revenue loss.

Penalties for Non-Compliance

Contrary to the benefits of adherence, PCI-DSS non-compliance can be costly. Penalties could range from monetary fines levied by card issuing banks to suspension of card processing privileges. In some cases, the business may face legal consequences, thus adding onto the damage on their reputation.

Regulatory Framework for PCI-DSS

Without a doubt, maintaining the integrity of cardholder data is crucial. There’s a need for a comprehensive regulatory framework to ensure adherence to PCI-DSS standards.

The PCI Security Standards Council

The PCI Security Standards Council is an open global forum responsible for the ongoing development, enhancement, and dissemination of the PCI Security Standards. The council offers robust, comprehensive standards and supportive materials to boost payment card data security.

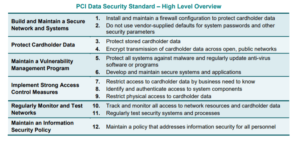

PCI-DSS Requirements

The PCI Data Security Standard specifies twelve requirements for compliance, grouped into six logically related groups called ‘control objectives.’ These requirements include building and maintaining a secure network, protecting cardholder data, maintaining a vulnerability management program, implementing robust access control measures, regularly monitoring and testing networks, and maintaining an information security policy.

Role of Government Agencies

While the PCI Security Standards Council develops and manages the PCI standards, government agencies across the globe play a crucial role in enforcing these standards. Regulations like the GDPR in Europe highlight the importance of data protection, including cardholder data.

Starting your PCI-DSS Journey: Assessing Your Needs

PCI-DSS compliance is a business-specific process. Every organization needs to understand its particular requirements before embarking on the journey of compliance.

Determining your PCI-DSS Level

The first step is to ascertain your PCI-DSS level. This step is based on the total volume of transactions that your business processes annually. Different levels require different validation requirements, so understand your level before proceeding.

Identifying Cardholder Data

Next, you need to identify where cardholder data resides in your system. Once located, you can apply the necessary PCI-DSS security controls to secure it.

Mapping out your Card Data Environment

Once your card data is located, you should map your data environment. This process involves identifying all systems that interact with card data environment directly or indirectly. It assists in the accurate scoping of PCI-DSS assessment.

PCI-DSS Compliance Toolkit

Several tools and resources are available to help with PCI-DSS compliance.

PCI DSS SAQs

The Self-Assessment Questionnaires (SAQs) are essential tools provided by the PCI Security Standards Council. These questionnaires are designed to assist organizations in self-evaluating their compliance with PCI-DSS.

PCI-DSS Scoping Toolkit

The PCI-DSS scoping toolkit helps in the accurate and consistent identification and documentation of the systems that should be included in the PCI-DSS Assessment.

Indicators of Compromise (IoC) Scanner

An IoC scanner is used to identify threats in your network that could compromise card data. These threats might include anomalies, suspicious activities, or recognized attack patterns.

Professional Services for PCI-DSS Compliance

PCI-DSS compliance can be a complex process. As such, you may need the services of specialized professionals.

Qualified Security Assessors (QSAs)

QSAs are organizations that have been qualified by the PCI Security Standards Council to perform PCI-DSS assessments. They have specialized knowledge and tools to assist businesses in becoming compliant.

PCI Forensic Investigators (PFIs)

PFIs are trained and certified to conduct PCI-DSS forensic investigations. They could be useful in non-compliance scenarios or when data breaches have occurred.

Approved Scanning Vendors (ASVs)

ASVs provide network and application layer vulnerability scanning services and solutions to assist organizations achieve and maintain PCI-DSS compliance.

PCI-DSS Compliance Software Solutions & Platforms

Several software solutions and platforms are designed to help businesses achieve PCI-DSS compliance.

Firewalls and Intruder Detection Systems

Firewalls and intrusion detection systems are essential components for safeguarding cardholder data. These systems prevent unauthorized access, detect intrusions, and shield card data from cyber threats.

Encryption and Key Management Tools

Encryption tools protect card data during transmission while key management tools ensure that the encryption keys are securely stored, distributed, and retired.

Data Loss Prevention Software

Data loss prevention software helps secure cardholder data at rest. It monitors, detects and blocks data in use, in motion, and at rest through deep content analysis.

PCI Compliance Management Platform

A complete platform which helps manage all aspects of PCI compliance, including assessment, remediation, and reporting can be of great utility. Such a platform simplifies the process of maintaining compliance.

Best Practices for PCI-DSS

PCI-DSS compliance is more than meeting minimum requirements. It’s about adopting best practices that foster improved cardholder data security.

Restricting Data Access

Only people who require access to cardholder data to perform their jobs should have access. Limiting access reduces the risk of accidental leaks or theft of data.

Regular Network Testing

Regular testing can identify vulnerabilities and allow for remediation before a data breach occurs. This process ensures that your security systems are working optimally.

Strong Access Control Measures

Implementing strong access control measures safeguards against unauthorized access. This could involve unique IDs for each person with computer access and a robust authentication process.

Training and Resources for PCI-DSS Understanding

A thorough understanding of the PCI-DSS requirements and processes is crucial to achieving compliance. Several resources are available to help businesses gain the needed knowledge.

PCI-DSS Webinars and Workshops

These are professional learning platforms that can equip your team with the necessary knowledge of PCI-DSS requirements and best practices. They involve presentations, discussions, and Q&A sessions with PCI-DSS professionals.

Online Training Programs

Various on-demand online courses offer flexibility and fitted learning for businesses. These programs can provide a deep understanding of PCI-DSS.

Literature and Guides on PCI-DSS Compliance

Numerous guides, eBooks, and reference manuals are available and can serve as handy resources on PCI-DSS.

Success Stories: Examining Case Studies

Understanding how other businesses successfully implemented PCI-DSS or lessons learned from non-compliant businesses can be informative.

Enterprises Successfully Adopting PCI-DSS

Several businesses across the globe have successfully implemented PCI-DSS. Their solutions, strategies, and the benefits they reaped can provide valuable insights for businesses embarking on their PCI-DSS journey.

Lessons Learned from Non-compliant Businesses

Unfortunately, several businesses have suffered fines and reputational damage due to non-compliance. Evaluating such cases could provide a clear picture of the consequences of non-compliance and, thus, motivate adherence.

Keeping Pace with PCI-DSS Evolution

Given the dynamic nature of technology and cyber threats, the PCI-DSS standards are bound to evolve. As such, it is important for businesses to stay informed and adaptable.

Staying Informed About PCI-DSS Updates

Businesses must always be on the lookout for updates from the PCI Security Standards Council. Staying current ensures continued compliance even in the face of new rules.

Embracing Future Changes to PCI-DSS Compliance

PCI-DSS might introduce new requirements in response to emergent data security threats. Embracing these changes ensures that your business remains ahead of the game and protects cardholder data in a technologically evolving landscape.