In the realm of organizational security and customer confidence, the Payment Card Industry Data Security Standard (PCI-DSS) compliance reports hold a highly significant role. Your journey through the intricacies of these reports will equip you with the necessary knowledge to understand their usage, the requirement measures, and their influence on business practices globally. ‘Unravelling the Usage of PCI-DSS Compliance Reports’ can be considered your professional guide to grasping the full scope, purpose, and utilization of these indispensable security reports in today’s digital-driven commercial landscape.

Understanding PCI-DSS Compliance Reports

Payment Card Industry Data Security Standard (PCI-DSS) compliance reports are critical tools used by organizations to ensure their payment card data is secured. These reports map out an organization’s adherence to the standards set by the PCI Security Standards Council.

Purpose of PCI-DSS compliance reports

The primary purpose of the PCI-DSS compliance reports is to provide a detailed analysis of an organization’s cardholder data environment in relation to the industry standards. They highlight the effectiveness of data security measures, identify areas of non-compliance, and provide recommendations for improvement. By evaluating these reports, you can ensure that your organization’s data security measures effectively mitigate risks, safeguard sensitive data, and comply with the prescribed standards.

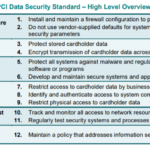

Overview of PCI standards

To understand PCI-DSS compliance reports, it’s crucial to first comprehend what the PCI standards entail. PCI standards are security measures designed to ensure all organizations dealing with credit card information maintain the highest levels of security. The standards are broad, encompassing areas such as network security, data protection, vulnerability management, access control, network monitoring, and information security policies.

Elements of a PCI-DSS Compliance Report

Knowing the elements that make up a PCI-DSS compliance report is critical in understanding the report.

Overview of the contents of a report

A typical PCI-DSS compliance report consists of sections that outline the scope of the review, the status of compliance with each PCI standard, remediation steps for non-compliance, and recommendations for further enhancing security procedures. It also includes an executive summary, detailed findings and observations, and a timeline for remediation.

Explanation of metrics used in the report

The compliance report employs various metrics that measure the effectiveness of your compliance initiatives. These metrics might include a conformance rating that determines your organization’s alignment with the PCI-DSS requirement, or a risk score that gauges the extent of risk posed by your current data security practices. Each metric provides valuable insights, facilitating the detection of weaknesses and guiding informed decision-making.

The Role of PCI-DSS Compliance in Business

PCI-DSS compliance plays a vital role in ensuring that businesses operate securely and maintain customer trust.

Importance of PCI-DSS Compliance for organizations

The importance of PCI-DSS compliance cannot be overstated. It establishes trust among customers, reduces the risk of data breaches, and helps organizations avoid hefty penalties for non-compliance. In addition, it helps in protecting the organization’s reputation, which could be severely damaged in case of a data breach.

Potential impacts of non-compliance

Non-compliance can lead to a range of repercussions, including fines, penalties, and potential legal action. Perhaps even more devastating, it could cause significant harm to an organization’s reputation. In extreme cases, non-compliance could lead to the withdrawal of the ability to accept card transactions, crippling the organization’s operations.

Auditing and the PCI-DSS Compliance Report

Understanding the role of auditing in the context of PCI-DSS compliance reporting is vital.

Role of an auditor in PCI-DSS compliance

A PCI auditor, also known as a Qualified Security Assessor (QSA), plays an essential role in the compliance process. The QSA evaluates the organization’s security measures against the PCI-DSS, generates the compliance report, and recommends actions for remediation.

Types of audits for PCI compliance

There are two primary types of PCI audits: on-site audits and self-assessment questionnaires. On-site audits involve a comprehensive analysis of your organization’s processes by a certified QSA. On the other hand, the self-assessment questionnaire is a self-evaluative tool for organizations to measure their PCI-DSS compliance.

Understanding the PCI-DSS Compliance Report Generation Process

Getting to grips with the PCI-DSS compliance report generation process is crucial in maintaining ongoing compliance.

How to create a PCI-DSS compliance report

The process of creating a PCI-DSS compliance report starts with the collection of data on your cardholder data environment. This information is then analyzed in reference to the PCI standards. The third stage of the process involves the documentation of the findings and the creation of the compliance report.

Frequency of generating the report

PCI-DSS compliance is an ongoing process, and organizations are required to conduct regular assessments. While the frequency may differ depending on your organization’s specific requirements or transaction volume, it is generally recommended to conduct a PCI-DSS assessment annually.

Key Metrics in a PCI-DSS Compliance Report

Understanding the key metrics in a PCI-DSS compliance report is vital for identifying performance gaps and implementing effective remediation strategies.

How to interpret key metrics in the report

Interpreting these metrics involves understanding each PCI-DSS requirement and evaluating your organization’s compliance status against it. Metrics such as a conformance rating or risk score provide insight into compliance gaps and highlight areas that need immediate attention.

Importance and value of metrics used in the report

The metrics used in a PCI-DSS compliance report are of immense value, as they provide a comprehensive view of your cardholder data environment wellness. They help identify weaknesses, prioritize improvements, and measure progress over time against the PCI standards.

Increasing the Value of Your PCI-DSS Compliance Report

PCI-DSS compliance reports hold great value, and their accuracy directly impacts the effectiveness of the remediation strategies implemented.

Tips for increasing accuracy of a report

Improving the accuracy of your compliance report involves regularly updating security controls, thoroughly documenting all aspects of your cardholder data environment, and providing comprehensive evidence of each PCI-DSS requirement met.

Benefits of continuously maintaining compliance

Continuous compliance improves security, builds customer trust, and reduces the risk of costly data breaches. Regular audits and PCI-DSS compliance reports help ensure that you remain in line with the PCI standards and instill a culture of ongoing security in your organization.

Limitations of PCI-DSS Compliance Reports

While PCI-DSS compliance reports are an excellent tool for ensuring data security, they do have certain limitations.

Known limitations in scope and accuracy

The scope of these reports is limited to the organization’s cardholder data environment. This means areas outside of it, but which could potentially impact data security, are not typically covered. Further, the reports provide a snapshot of compliance at a given point in time, meaning the accurate depiction of ongoing compliance could be a challenge.

Addressing limitations in the report

One way of addressing these limitations is by broadening the scope of the PCI-DSS assessment to include all areas that handle sensitive information. Additionally, continuous monitoring and frequent audits can help ensure the report provides an accurate reflection of ongoing compliance.

Case Study: Real-World PCI-DSS Compliance Reporting

By examining real-world cases of PCI-DSS compliance reporting, we can better understand their application, benefits, and potential challenges.

Analysis of real world examples of PCI-DSS compliance

Across varying industries, organizations have benefited from PCI-DSS compliance reports through identifying and addressing security gaps, thereby mitigating potential risks. However, some have faced challenges in areas like scope determination, documentation, and ongoing compliance verification.

Lessons learned from case studies

These cases highlight the importance of understanding and correctly implementing PCI-DSS standards. Also, they underscore the value of continuous compliance, regular audits, and the proactive management of potential risks.

Future Trends in PCI-DSS Compliance Reporting

As the digital landscape continues to evolve, so too will PCI-DSS compliance reporting.

Evolution of PCI-DSS standards

PCI-DSS standards are continuously being updated to address the changing security landscape and to incorporate emerging technologies. Future updates will likely see a further focus on encryption, cloud environments, and the increasing proliferation of mobile transactions.

Impacts of emerging trends on compliance reports

The emergence of new technologies and ever-evolving cyber threats will impact the contents and requirements of PCI-DSS compliance reports. Businesses will need to stay abreast of these trends to ensure that their reports are comprehensive, accurate, and reflective of the current security context.

In conclusion, understanding and effectively using PCI-DSS compliance reports are vital for businesses that deal with cardholder data. By continuously maintaining compliance, addressing limitations, and adapting to future trends, your organization can enhance its data security measures and safeguard against potential risks.