Navigating a PCI-DSS audit can often feel like a daunting task for businesses, not least when discrepancies are discovered. “Understanding How a Business Can Dispute Findings in a PCI-DSS Audit”, a comprehensive exposition, guides you through the process of challenging such findings effectively. This resource showcases relevant procedures, legislative contexts and expert advice, providing you with the tools and knowledge to advocate for your business interests within the sphere of PCI-DSS compliance standards.

This image is property of itsupportguys.com.

Background on PCI-DSS Audits

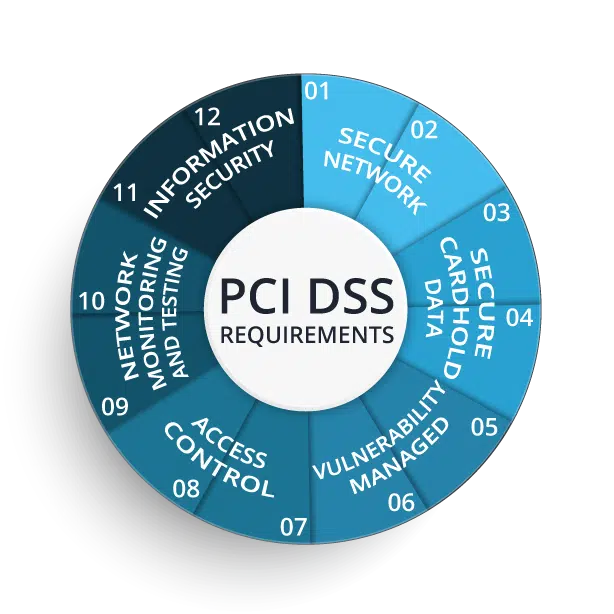

To fully understand how a business can dispute findings in a PCI-DSS audit, one must first grasp the concept of PCI-DSS and its audits.

Explanation of PCI-DSS

Payment Card Industry Data Security Standard, commonly known as PCI-DSS, is an international security standard designed to ensure companies that accept, process, store, or transmit credit card information maintain a secure environment. It includes the implementation of strong multifaceted security measures such as data encryption, intrusion detection systems, and regular vulnerability tests, among others.

Why PCI-DSS audits are necessary for businesses

The PCI-DSS audit is essential for businesses because it acts as a stringent, recurring check that verifies if a company is still adhering to the necessary security measures that protect against data breaches. It helps to maintain consumer trust and safeguards the company’s reputation by preventing security incidents that could lead to financial losses.

What happens during a PCI-DSS audit

During a PCI-DSS audit, a trained and certified auditor assesses the company’s network, IT systems, security policies, and procedures to ensure they fit within the PCI-DSS requirements. The auditor performs vulnerability scans, conducts staff interviews, and reviews documentation among other activities. The audit results in findings that are categorized as compliant or non-compliant with the relevant PCI-DSS controls.

Understanding Audit Results

How to interpret PCI-DSS audit findings

Interpreting PCI-DSS audit findings involves a critical review of the auditor’s report. Each finding is tied to a specific PCI-DSS requirement, and the report generally categorizes the company’s compliance level as either compliant or non-compliant.

The difference between compliant and non-compliant findings

A compliant finding means that your business has met the PCI-DSS requirements for a particular control. On the other hand, a non-compliant finding means that you have failed to meet one or more requirements. Non-compliance could result from inadequate policies, procedures, documentation, or technical controls.

The ramifications of a non-compliant audit

Non-compliance with PCI-DSS requirements can lead to serious consequences. Your business could face fines or penalties, be liable for damages arising from potential data breaches and even lose the ability to process card payments. On an intangible level, non-compliance can also lead to damage to your company’s reputation.

This image is property of sprinto.com.

Grounds for Disputing Audit Findings

Determining when to dispute a finding

A company may consider disputing a finding when it believes that the auditor has made an error in their assessment or if they think they have compelling evidence showing compliance with the standards.

Possible reasons for disagreement with the audit result

Disagreements can arise due to various reasons. For example, there might be a misinterpretation of the PCI-DSS requirements, a failure to consider the company’s compensating controls, or an oversight of information during the audit.

Understanding auditor’s possible mistakes

Auditors are human and can make mistakes. They might miss evidence of compliance, misinterpret the requirements of PCI-DSS, or might not completely understand the unique technical environment of your business.

Preparing for the Dispute

Gathering supporting documentation

It’s crucial to have all supporting documentation demonstrating your compliance status ready. This includes data flow diagrams, system configurations, security policies, training records, and any other relevant documents.

Procuring independent evidence

To challenge the auditor’s findings effectively, obtaining independent evidence, such as logs or results from your network monitoring systems, can be instrumental.

Engaging expert opinions

Sometimes, it might be necessary to engage external experts who can provide an authoritative opinion on your compliance. Their endorsements can greatly strengthen your dispute.

This image is property of sprinto.com.

The Dispute Process

Steps involved in the dispute process

The dispute process usually involves submitting a written appeal to the auditing body, outlining your objections and supporting your dispute with relevant documentation.

Involvement of the legal team

Your legal team needs to be involved in crafting the dispute to ensure that it adheres to all necessary legal standards and adequately defends the organization.

Communication during the dispute process

The dispute process also requires regular communication with the audit body to clarify the dispute, provide additional documentation, and facilitate the resolution of the dispute.

Disputing Non-Compliant Findings

Explanation of non-compliant disputes

A non-compliant dispute is a disagreement with the finding that the organization has not met one or more PCI-DSS requirements.

How to effectively challenge non-compliant findings

To effectively challenge non-compliant findings, you should be precise about what you’re disputing, provide clear arguments backed by concrete evidence, and depict a strong understanding of the PCI-DSS standards.

Outcome possibilities of non-compliant disputes

Successful disputes can result in alterations to the audit report or a decision that verified non-compliance is, in fact, a compliance. In contrast, unsuccessful disputes may affirm the initial audit findings, requiring you to rectify the unresolved issues.

This image is property of sprinto.com.

Persuasively Presenting Your Case

Structuring your argument

Your argument should be well-structured. It should be clear, focused, and should address each non-compliant finding individually.

Incorporating evidence

You must back up your arguments with substantial and relevant evidence. This should include documentation, logs, and expert opinions.

Involving the right stakeholders

The right stakeholders, such as security and IT experts, managers, and the legal team, must be involved in the process so that the dispute reflects the combined expertise of the organization.

Post-Dispute Steps

What to expect after the dispute

After the dispute, you could either have your compliance status changed, or you may be required to make changes to meet the PCI-DSS requirements if the dispute was unsuccessful.

Necessary updates to security protocols

Regardless of the dispute’s outcome, you should consider the audit findings to improve your security protocols and better comply with PCI-DSS requirements in the future.

Improving compliance measures for future audits

The dispute process provides valuable insights that you can use to enhance your compliance measures for future audits.

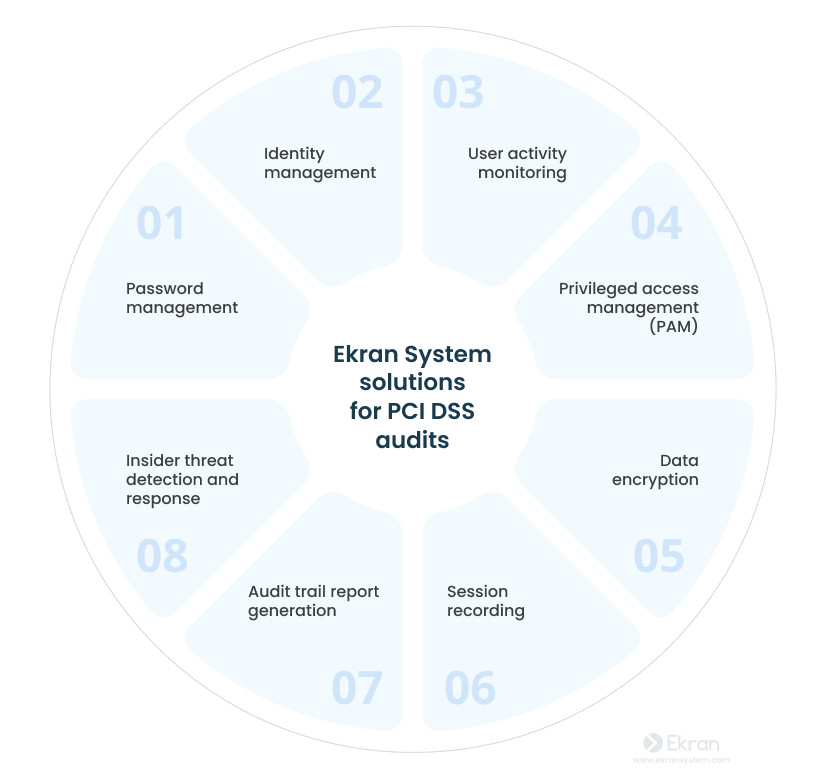

This image is property of ekran_site_uploads.storage.googleapis.com.

Case Studies of Disputed Audit Findings

Real examples of businesses disputing findings

Case studies provide insights into how different organizations have challenged non-compliant findings, the arguments they’ve put forth, and their dispute outcomes. These cases provide valuable practical knowledge on how to navigate audit disputes.

Effectiveness of disputes on audit outcomes

Case studies reveal that well-grounded disputes can indeed influence audit outcomes, correcting errors in audits, and leading to successful compliance recognition.

Impact of successful disputes on business operations

Successful disputes can lead to cost savings in terms of avoided fines and penalties. Also, they restore and enhance stakeholder confidence, ensuring the smooth running of business operations.

Tips for Successful Audit Disputes

Key factors for success in disputing audit outcomes

Thorough preparation, well-articulated arguments supported by evidence, involving the right stakeholders, and understanding the auditors’ perspective are keys to successful disputes.

Common mistakes to avoid

Overlooking the availability of significant internal documents, misconstruing audit requirements, or failing to involve the right experts in the organization can hamper the chances of a successful dispute.

Navigating the complexity of the dispute process

Understanding how to effectively navigate the dispute process is critical. This includes knowing when, how, and what to communicate, and ensuring timely and appropriate responses. Thus, while PCI-DSS audits are a necessity, there may be situations where your business may need to dispute the findings. Identifying those situations, preparing thoroughly, engaging the right stakeholders, and making persuasive arguments are key steps in resolving audit disputes successfully. Meanwhile, remember that audits, and even disputes, are opportunities to improve, ultimately enhancing your business’s security posture and compliance efficacy.