In the paradigm of digital transactions, businesses continuously seek streamlined systems to maintain efficacy and security. “Exploring the Impact of Outsourcing Payment Processing on PCI-DSS Compliance” provides a comprehensive treatment of the potential outcomes of entrusting an external party with payment processing responsibilities on your PCI-DSS compliance. You are taken on a journey that maps out the implications, benefits or setbacks, regulatory requirements and strategic insights that come along with such decisions. This assessment helps you understand whether this strategy can boost your business dynamics and compliance or erect unforeseen challenges.

Understanding the basics of PCI-DSS Compliance

Understanding PCI-DSS compliance is pivotal for any business that collects, stores, processes or transmits cardholder data. PCI-DSS stands for Payment Card Industry Data Security Standard, which is a global standard developed by credit card companies to ensure a secure environment for card transactions.

Definition of PCI-DSS

In essence, PCI-DSS is a set of stringent security standards designed to ensure that all businesses that accept, process, store or transmit credit card information maintain a secure environment. This is aimed towards protecting the cardholder’s personal and financial data from fraud and data breaches.

Importance of PCI-DSS Compliance

The importance of PCI-DSS compliance cannot be overstated. Non-compliance can lead to hefty fines, loss of ability to accept card payments, lawsuits, and even loss of brand reputation. It not only ensures protection of sensitive customer information but also boosts the trust and credibility of a business in a customer’s eye.

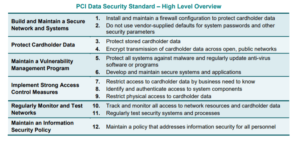

Main requirements for PCI-DSS Compliance

In achieving the PCI-DSS compliance, there are 12 main requirements laid down, divided into 6 broader objectives. These include: building and maintaining secure network and systems; protecting cardholder data; maintaining a vulnerability management program; implementing access control measures; monitoring and testing networks regularly; and maintaining an information security policy.

The Rise of Outsourcing Payment Processing

Outsourcing payment processing is becoming increasingly common among businesses as it offers a variety of benefits that aids operational efficiency and cost management.

Reasons businesses choose to outsource payment processing

Outsourcing payment processing can have several benefits such as reduced operational costs, increased efficiency, access to advanced technology, and the ability to focus on core business functions. Furthermore, it can also ease the burden of maintaining PCI-DSS compliance.

Various forms of payment processing that can be outsourced

There are a number of forms of payment processing that can be outsourced. These include card processing, electronic check processing, point-of-sale (POS) transactions, mobile payment processing, and electronic invoicing and billing, among others.

Analysis of payment processing outsourcing providers

Outsourcing providers perform a crucial function in the entire payment processing ecosystem and are duly bound to maintain PCI-DSS compliance.

How outsourcing providers maintain PCI-DSS Compliance

Just like any business that handles cardholder data, outsourcing providers are required to be PCI-DSS compliant. This means adhering to the same set of security standards for securing cardholder data, including implementation robust security measures, regular monitoring, and consistent testing of their systems and processes.

Necessity of verification processes by outsourcing providers

Verification processes are key to the work of outsourcing providers. These processes include thorough checks to ensure that their systems and protocols are compliant with PCI-DSS standards, and that the cardholder data they handle is kept secure throughout the payment processing flow.

Impact of Outsourcing on PCI-DSS Compliance

While outsourcing can certainly benefit a business, it also has implications when considering the need for PCI-DSS compliance.

Positive impacts of outsourcing payment processing on PCI-DSS Compliance

Outsourcing payment processing can have several positive impacts on PCI-DSS compliance. By shifting the responsibility and task of protecting cardholder data to a third-party expert, businesses can effectively reduce their own burden of compliance. Furthermore, providers with specialized knowledge in the field can ensure top-level compliance assurance.

Potential risks involved

By outsourcing payment processing, businesses expose themselves to risks. If the outsourcing provider does not maintain strict adherence to PCI-DSS norms, it can result in data breaches. It’s crucial to choose a provider that takes the task of compliance seriously, given that the ramifications of a security breach can have business-ending consequences.

Responsibility Shift in Compliance

Alongside the various benefits and potential drawbacks, outsourcing also brings a crucial responsibility shift in terms of PCI-DSS compliance.

How responsibility for compliance shifts when payment processing is outsourced

The responsibility for compliance shifts from the outsourcing organization to the service provider. However, while the task of compliance is handled by the third-party, the ultimate responsibility of ensuring that compliance is met remains with the original business.

Challenges in managing this responsibility shift

Managing this responsibility shift can be challenging. Cooperation, regular communication and detailed contract terms are key to ensure the smooth operation between both parties.

Case Studies of Outsourcing and PCI-DSS Compliance

There are various examples of businesses that have found success in outsourcing payment processing, as well as those who have faced compliance issues.

Companies that have successfully outsourced payment processing

Many businesses, from large corporations to small enterprises, have successfully outsourced their payment processing functions. Owing to confidentiality, specific cases are not often disclosed. However, these companies have been able to streamline their operations and reduce costs effectively by doing so.

Examples of PCI-DSS compliance complications arising from outsourcing

While there are numerous successful stories, there are also instances where outsourcing resulted in compliance issues. In most cases, these instances aroused from miscommunication between the company and the outsourcing provider, or from the provider’s negligence or lack of knowledge about PCI-DSS compliance.

Enhancing PCI-DSS Compliance When Outsourcing Payment Processing

While outsourcing may present its own set of challenges, there are effective strategies to enforce PCI-DSS compliance.

Strategies for ensuring PCI-DSS compliance

Businesses can adopt various strategies to ensure compliance. These include conducting regular audits, implementing a robust contract that clearly delineates responsibilities, and frequent communication to monitor the activities.

Involvement of third-party risk management

Also important is the involvement of third-party risk management. A dedicated risk management team can keep an eye on the operations of the outsourcing provider, with a keen focus on security measures and breach readiness.

Addressing Outsourcing Risks to Secure PCI-DSS Compliance

It’s impertinent to address and mitigate the risks emerging from outsourcing to secure PCI-DSS compliance.

Best practices for vetting outsourcing providers

The first step in venturing into outsourcing is choosing the right provider. It’s essential to thoroughly vet potential providers, analyse their past performance, and ascertain their commitment towards data security.

Risk mitigation strategies

Implementing risk mitigation strategies is paramount to addressing potentials risks. Regular audits, stringent contractual obligations, and stringent data security protocols can significantly reduce the risk profile.

Frequently Asked Questions Regarding Outsourcing and PCI-DSS Compliance

This section aims to clarify misconceptions and provide practical advice.

Clarifying misconceptions

There is a commonly held misconception that outsourcing absolves businesses of any responsibility for data breaches. However, it’s vital for businesses to understand that the ultimate responsibility remains in their hands.

Providing practical advice

Getting the PCI-DSS compliance right is a critical task, often best left to the experts. Practical advice can include staying up-to-date with the ever-changing compliance landscape, regular audits and risk analysis, and choosing a reputable and experienced outsourcing provider.

The future outsourcing payment processing and PCI-DSS Compliance

The future of outsourcing payment processing looks bright, with new technologies and trends emerging.

Emerging trends

With the advent of new forms of payment such as cryptocurrencies, mobile payments, and digital wallets, the payment processing landscape is changing. Outsourcing providers are likely to cater for these new payment platforms to keep up with the changing market need.

Impact of new technology

New technology implies more sophisticated tools for handling data and security. As these technologies further advance, outsourcing providers will need to remain up-to-date to provide secure and efficient services.

Predicted changes to PCI-DSS compliance with advances in outsourcing

Advancements in outsourcing and payment technologies may lead to changes in PCI-DSS compliance regulations. To this end, both businesses and outsourcing providers must stay abreast of these changes to ensure continuous compliance.