In recent times, the Payment Card Industry Data Security Standard (PCI-DSS) has emerged as an essential element in safeguarding wireless and mobile payment systems. You might have wondered about its role and application in shaping these rapidly evolving payment platforms. This article, titled “Understanding the Application of PCI-DSS in Mobile and Wireless Payment Systems,” will offer detailed insight into how PCI-DSS serves as a fundamental pillar in securing these financial transactions, specifically in the sphere of mobile and wireless platforms. Expect to uncover the integral functions of PCI-DSS and its crucial position in reinforcing the security of payment processes.

Definition and Overview of PCI-DSS

The Payment Card Industry Data Security Standard (PCI-DSS) is a worldwide standard that was established to assist businesses process card payments securely and reduce card fraud. It achieves this by tightening controls around cardholder data and aiming to protect card information. Any business that processes, stores or transmits credit card numbers must be PCI DSS compliant.

Understanding the PCI-DSS Terminologies

PCI-DSS terms can appear complex but are essential for a comprehensive understanding of the standard. The term ‘cardholder data’ typically refers to any information contained on a customer’s payment card like the cardholder’s name, expiry date, and service code. Cardholder data also includes Sensitive Authentication Data (SAD): full magnetic stripe data, card verification codes/values (CVC/CVV), PINs and PIN blocks – all critical data that need to be protected. ‘Payment channels’ refer to either card-present (CP), where the cardholder presents the card for payment; or card-not-present (CNP), typically online or phone transactions where the card is not physically presented.

Brief History of PCI-DSS

PCI-DSS was launched in December 2004 by the PCI Security Standards Council, a global forum responsible for the development, enhancement, dissemination and assistance with the understanding of security standards for payment card data protection.

Importance of PCI-DSS in Data Security

PCI-DSS ensures that all organisations comply with the same universal standards for secure data handling. Its importance lies in its ability to protect sensitive cardholder data throughout the transaction process, thereby helping to reduce the likelihood of data breaches and fraud.

Mobile and Wireless Payment Systems

Mobile and wireless payment systems have revolutionised how we conduct transactions. These systems allow you to make payments using telecommunications networks offering the convenience of making payments anywhere, anytime.

Understanding Mobile Payment Systems

Mobile payment systems refer to transactions that are conducted through wireless handheld devices such as mobile phones or tablets.

Various Types of Wireless Payment Systems

A range of wireless payment methods have emerged including mobile wallets like Google Pay and Apple Pay, NFC payments, SMS-based payment solutions, and mobile banking.

How Mobile and Wireless Payment Systems Work

Such systems primarily work by storing your credit or debit card information on your device, then utilizing technology like NFC or security features such as one-time passcodes or biometrics to initiate and authenticate transactions.

Security Concerns in Mobile and Wireless Payment Systems

Despite the convenience and speed they offer, mobile and wireless payment systems carry a range of security concerns.

Common Security Vulnerabilities

Some prevalent vulnerabilities in mobile and wireless payment systems include threats like data interception, weak data encryption, malware attacks, and issues related to lost or stolen devices.

Examples of Security Incidents in Mobile and Wireless Payment

There have been several incidents where mobile and wireless payment systems have been compromised. These incidents often involve unauthorized access to user accounts, with fraudsters able to conduct transactions using stolen account data.

Impacts of Security Breaches in Mobile Payments

Security breaches in mobile payments can lead to substantial financial losses and reputational damage for businesses. They can also result in loss of customer trust, which can be more detrimental to a business than the immediate financial loss itself.

The Role of PCI-DSS in Mobile and Wireless Payment Security

PCI-DSS plays a crucial role in enhancing the security of mobile and wireless payment systems.

How PCI-DSS Enhances Security in Mobile and Wireless Payment Systems

PCI-DSS recommends multiple layers of controls to protect cardholder data and involves a multifaceted security strategy that addresses important aspects such as network architecture, software design, security management procedures, and other protective measures.

Benefits of Implementing PCI-DSS in Mobile and Wireless Payments

Implementing PCI-DSS in mobile and wireless payment systems can help reduce the risk of data breaches, promote customer confidence, avoid potentially costly fines for non-compliance, and ensure the steady flow of business with card networks.

PCI-DSS Standards and Requirements

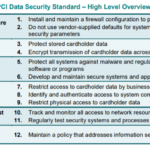

The PCI Security Standards Council has laid out a set of 12 detailed requirements for PCI-DSS compliance which are categorized into six broader goals.

Overview of PCI-DSS Requirements

The requirements range from building and maintaining a secure network, to protecting cardholder data, maintaining a vulnerability management program, implementing strong access control measures, regularly monitoring and testing networks, and maintaining an information security policy.

Detailed Breakdown of PCI-DSS Standards

Each of these requirements holds a range of detailed specifications. For instance, to build and maintain a secure network, the PCI DSS requires that you install and maintain a firewall configuration and do not use vendor-supplied defaults for system passwords and other security parameters.

Importance of Complying with Each PCI-DSS Requirement

Each requirement carries a specific purpose. Non-compliance with even a single one can leave a potential vulnerability that could be exploited, resulting in a security breach.

Implementing PCI-DSS in Mobile and Wireless Payment Systems

Successfully implementing PCI-DSS requires careful planning and execution.

Steps in Implementing PCI-DSS

It involves steps like assessing the current payment environment, identifying vulnerabilities, fixing vulnerabilities and maintaining security. Additionally, businesses need to fill out periodic self-assessment questionnaires and undergo routine PCI-DSS compliance audits.

Challenges in Implementing PCI-DSS

Challenges in implementing PCI-DSS may include dealing with the complexity of the standard, the cost of implementation, absence of skilled security personnel, and the continuous effort required to maintain compliance.

Case Studies of Successful PCI-DSS Implementation

Successful implementation of PCI-DSS in mobile and wireless payments can be seen in many globally recognized companies that have strengthened their security postures, improved customer trust and maintained continuous business operations.

Regular Monitoring and Compliance with PCI-DSS

Regular monitoring and maintaining PCI-DSS compliance is a continuous process that is crucial for keeping data secure.

Importance of Regular Monitoring

Regular monitoring is essential to ensure that security controls are working effectively and that any potential security breach can be detected in a timely manner.

Methods and Strategies for Ensuring Compliance

Methods such as regular audits, network monitoring, penetration testing, vulnerability scanning, and staff training can greatly help in maintaining PCI-DSS compliance.

Consequences of Non-compliance with PCI-DSS

Non-compliance with PCI-DSS can result in hefty fines, increased transaction fees, loss of goodwill among customers, and in severe cases termination of the ability to accept card payments.

Future of PCI-DSS in Mobile and Wireless Payment security

As technology advances, PCI-DSS will continue to adapt and evolve to meet new security challenges.

Emerging Trends in Mobile and Wireless Payment Security

Emerging trends such as biometric authentication, tokenization, and AI in fraud detection are shaping the future of mobile and wireless payment security.

Possible Improvements to PCI-DSS

PCI-DSS may need to include more explicit requirements for these emerging technologies and bolster requirements for authentication and tokenization to ensure continued robust security in the evolving landscape.

Impact of Technological Advancements on PCI-DSS

Technological advancements, particularly in mobile devices and applications, wireless technology, and encryption methods, will continue to influence the evolution of PCI-DSS.

Training and Awareness of PCI-DSS in Mobile and Wireless Payment Systems

Creating awareness and providing adequate training is an essential part of PCI-DSS compliance.

Importance of Staff Training on PCI DSS

Training allows staff to understand the importance of the standard, their role in maintaining compliance, and the potential implications of non-compliance making it easier for them to follow the recommended practices.

Creating Awareness among Users

End-users also need to be aware of their role in maintaining security. This can be achieved by providing regular security updates, recommended security practices and steps to follow in case of suspected security breaches.

Recommended Training Programs and Resources

Various organisations offer training programs and resources to help businesses achieve and maintain PCI-DSS compliance.

Conclusion: The Impact of PCI-DSS on Mobile and Wireless Payment Systems

PCI-DSS has a profound impact on ensuring the security of mobile and wireless payments.

Key Impacts of PCI-DSS on Mobile and Wireless Payment Systems

It has brought about the implementation of rigorous security practices in mobile and wireless payments, resulting in a more secure and reliable payment environment.

Lessons Learnt

Among the key takeaways are the importance of continuous compliance with PCI-DSS, investment in staff training and awareness, and the necessity for continuous monitoring and assessment of security controls.

Future Prospects of PCI-DSS in Mobile and Wireless Payment Systems

The future of PCI-DSS lies in its ability to tackle emerging threats in mobile and wireless payment security and providing a robust framework for secure card transactions. It will remain a significant player in providing protection for cardholder data and mitigating the risk of card fraud in a rapidly evolving finance landscape.