In the complex landscape of cybersecurity, businesses often grapple with navigating through the Payment Card Industry Data Security Standard (PCI-DSS). The article “Understanding partial compliance in PCI-DSS for Businesses” provides a comprehensive insight into the intriguing concept of partial compliance. It delineates how businesses could potentially fall into this quasi category, the implications of such a status and it gives a detailed discussion on the degree to which a company can be in sync with the PCI-DSS while being partially compliant. Get prepared to gain a unique perspective on PCI-DSS compliance for businesses.

Understanding PCI-DSS

Definition of PCI-DSS

PCI-DSS, or Payment Card Industry Data Security Standard, is a global set of security standards designed to ensure all companies that handle cardholder information for debit, credit, prepaid, e-purse, ATM, and POS cards maintain a secure environment. Instituted by the Payment Card Industry Security Standards Council, it aims to protect consumer data and reduce credit card fraud.

Importance of PCI-DSS in businesses

PCI-DSS is crucial for businesses as it helps protect their customers’ sensitive payment card data. Compliance with PCI-DSS shows that your business takes customer security seriously and safeguards against financial loss from data breaches. It also builds trust with your clients, strengthening your business reputation. Furthermore, if your organization processes, stores, or transmits cardholder data, it is required to comply with this standard.

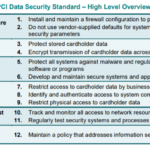

Major components of PCI-DSS

The PCI-DSS comprises 12 main requirements divided into 6 related groups. These include: Building and maintaining a secure network, protecting cardholder data, maintaining a vulnerability management program, implementing robust access control measures, regularly monitoring and testing networks, and maintaining an information security policy.

Concept of Partial Compliance in PCI-DSS

Exploring the possibility of partial compliance

Partial compliance refers to the situation where a business meets some, but not all, of the PCI-DSS requirements. While it’s an improvement from total non-compliance, it still leaves your customers’ data vulnerable to breaches and your business exposed to penalties and reputational damage.

Understanding the areas of partial compliance

Partial compliance can arise in many areas depending on which part of the PCI-DSS your business does not meet. For instance, incomplete implementation of security measures, insufficient security policies, or poorly maintained systems are all instances of partial compliance.

Consequences of partial compliance

Although partial compliance may seem better than outright non-compliance, it still poses significant risks. For one, your business could experience a data breach resulting in financial losses, legal penalties, and reputational damage. It could also mean non-compliance fines from the card brands or acquiring banks. More importantly, it could put your customers’ data at risk, jeopardizing trust and business relationships.

Why Businesses Might Only Achieve Partial Compliance

Resource limitations

Developing and maintaining the systems, processes, and protocols required for PCI-DSS compliance can be resource-intensive. Smaller businesses, in particular, may find it challenging to commit enough time, personnel, or finance to ensure full compliance.

Unawareness or misunderstanding of the standards

Another reason for partial compliance is insufficient understanding of the PCI-DSS. Businesses may lack a clear comprehension of the requirements, leading to incorrect implementation of policies and protocols. Misunderstanding the rules can lead to missed compliance areas and potentially expose cardholder data to risk.

Organizational complexities

For large organizations with multiple departments handling cardholder data differently, achieving comprehensive compliance can be a complex task. There could also be internal resistance to change or lack of coordination among different departments, leading to gaps in compliance.

Determining Level of Compliance

Assessment processes for determining compliance

To determine your level of PCI-DSS compliance, an assessment is carried out. This involves reviewing your company’s cardholder data environment, policies, and procedures against the 12 requirements set out by the PCI-DSS.

Who validates the compliance

Depending on the volume of your transactions, compliance validation can be done either through a self-assessment questionnaire or by an external Qualified Security Assessor (QSA).

Illustrating levels of compliance

The levels of compliance range from Level 1 (highest volume of transactions, stringent requirements, external assessment compulsory) to level 4 (lowest volume of transactions, less rigorous requirements, often with self-assessment options).

Implications of Partial Compliance

Financial implications

Partial compliance could lead to financial penalties by card brands or banks due to non-compliance. Worse, it leaves your business vulnerable to data breaches, which could result in substantial financial losses from fraud and potential lawsuits.

Reputational implications

Trust is critical in business relationships. Partial compliance risks damaging your reputation among customers who trust you with their payment card data. Businesses seen as neglecting important security measures could lose customer confidence and suffer loss of business in the long run.

Operational implications

The effort to clean up after a data breach and the restructuring needed to reach full compliance could disrupt regular operations. Additionally, the resources needed to pay penalties and deal with legal issues could detract from your core business operations.

Maintaining Compliance

Importance of ongoing compliance

Ongoing compliance is mandatory and crucial because the threat landscape is always changing. Regularly assessing, monitoring, and improving your security posture as per PCI-DSS guidelines helps keep your cardholder data environment secure.

Best practices for compliance maintenance

Best practices include regular checks and updates to ensure security systems are robust, conducting regular risk assessments, providing staff training, maintaining a clear and updated data management policy, and monitoring and testing networks frequently.

Monitoring and reporting for maintaining compliance

Continuous monitoring and timely reporting can allow you to detect any non-compliance issues at an early stage and rectify them before they become huge issues. Regularly generating and reviewing reports can help ensure you stay on top of your compliance level.

Moving from Partial to Full Compliance

Steps toward achieving full compliance

Transitioning to full compliance requires understanding what’s causing partial compliance, then devising and implementing a plan to address the gaps. This might involve allocating more resources, providing extensive staff training, and employing a systematic, organisation-wide approach to data security.

Required resources for full compliance

Full compliance might require significant resources including hiring a dedicated data security team, investing in secure technology, seeking assistance from PCI-DSS consultants, and setting aside time and resources for staff training and system assessment.

Time frame for achieving full compliance

The timeframe for reaching full compliance depends on your current compliance stage and resource availability. Regardless, it is critical not to treat compliance as a one-time project but rather as an ongoing process requiring consistent attention and improvement.

Effects of Non-Compliance

Penalties for non-compliance

Non-compliance can result in penalties from the PCI-DSS council, banks, or credit card brands. Fines can range from thousands to millions of dollars, based on the severity and duration of non-compliance.

Real-world examples of non-compliance consequences

Real-world examples of non-compliance often involve substantial financial and reputational damage. Take, for instance, the infamous Target’s data breach, which resulted in a settlement of $18.5 million, not to mention steep reputational loss.

How non-compliance affects businesses and customers

Non-compliance not only leads to financial and reputational loss for businesses but also affects customers. Their payment data could be compromised, leading to potential financial losses and negative feelings towards your company.

Role of PCI-DSS Consultancies

Scope of work of a PCI-DSS consultancies

PCI-DSS consultants are experts who help businesses understand, implement, and maintain compliance with PCI-DSS standards. Their services may include compliance assessment, providing compliance solutions, training staff, and helping organizations develop a continuous compliance plan.

How they can help achieve full compliance

PCI-DSS consultancies use their expertise to help your business identify gaps in compliance and recommend ways to address them. Their external view can provide invaluable insights and help your organization become fully compliant sooner and with less internal stress.

Choosing the right PCI-DSS consultancy for your business

When selecting a PCI-DSS consultancy, consider their experience with businesses similar to yours, case studies, their understanding of your business processes, industry reputation, and the range of services they offer. Remember, they should not only help you reach compliance but also maintain it.

Improving PCI-DSS Understanding and Compliance

Educational resources for better understanding of PCI-DSS

Investing in educational resources such as guides, webinars, and online courses can improve your organization’s understanding of the PCI-DSS. Industry events and forums are also beneficial for learning from professionals and businesses who’ve successfully navigated the compliance journey.

Training for staff on PCI-DSS

Training your staff on the importance of PCI-DSS can not only improve their understanding but also foster a culture of compliance in your organization. Regular training sessions should be part of your ongoing compliance strategy.

Raising PCI-DSS awareness throughout the business

Promoting PCI-DSS awareness involves clearly communicating the relevance and benefits of compliance to every department. It helps reinforce the importance of safeguarding customers’ payment data and promotes a proactive security culture within your organization.

Remember, PCI-DSS compliance is vital for your customers’ trust, your financial security, and the overall success of your business. It’s not just about conforming to a standard; it’s about demonstrating your commitment to your customers’ safety and your business integrity.