Grasping the value and necessity of PCI-DSS for businesses is essential. In an era where customer data security protagonists in the corporate world, Payment Card Industry Data Security Standard (PCI-DSS) certification offers a mantle of safety and trust to both company and consumer. In this article, you will explore the reasoning behind the critical role PCI-DSS plays in securing businesses and discover how it elevates customer confidence through rigorous protection of sensitive cardholder data. By reading this paper, you’ll gain a comprehensive understanding of why PCI-DSS is indispensable for businesses targeting sustained growth and security in today’s tumultuous digital landscape.

Understanding PCI-DSS

The Payment Card Industry Data Security Standard (PCI-DSS) is an established set of policies and procedures that aims to optimize the security of debit, credit, and other related transactions. It upholds the protection of cardholder information against fraud and other forms of data breaches.

Definition of PCI-DSS

PCI-DSS, established by five major credit card brands: Visa, MasterCard, American Express, Discover, and JCB, is a universally acknowledged security standard for protecting cardholder data. This set of 12 comprehensive standards ensures secure management, storage, and transmission of sensitive personal and credit card information, protecting businesses and consumers from data breaches.

Role of PCI-DSS in businesses

By enforcing standard security procedures for handling customer card data, PCI-DSS plays a central role in maintaining customer trust, ensuring business reputation, and mitigating potential financial losses. Through boosting structural security measures, PCI-DSS compliance helps businesses meet the legal obligations, reducing the risk of security breaches.

The Importance of Compliance with PCI-DSS

Ensuring compliance with PCI-DSS doesn’t only keep the businesses secure from potential fraud but also enhances the reputation of the business.

Benefits of PCI-DSS compliance

Compliance with PCI-DSS provides several benefits. Firstly, it enhances cardholder data protection and reduces the substantial risk of data breaches. Secondly, it assists businesses in avoiding possible steep penalties associated with non-compliance. Finally, it boosts customer trust, as compliance shows a company’s commitment to secure operations.

Consequences of non-compliance

Non-compliance with PCI-DSS can trigger disastrous repercussions. These may include financial penalties, increase in transaction fees, loss of consumer trust, and severe damage to brand reputation. In worst-case scenarios, non-compliant merchants could lose the privilege of accepting card payments.

Security Parameters of PCI-DSS

The security parameters put in place by PCI-DSS ensure that cardholder data is effectively protected throughout each transaction process.

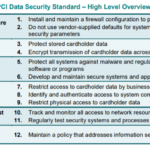

Understanding security requirements

PCI-DSS includes 12 security requirements that businesses must meet to become compliant. They range from building and maintaining a secure network system to implementing strong access control measures and continuously monitoring and testing networks.

Implementation of secure networks and systems

PCI-DSS requires businesses to maintain a secure network, which includes having a reliable firewall in place and ensuring that system passwords are unique and secure. It also requires businesses not to store cardholder data unless it’s necessary for business operation.

Protection of cardholder data

The standard has stipulated measures for protecting stored cardholder data while it’s being transmitted over open networks. It includes encryption, truncation, masking, and hashing of the data to prevent unauthorized access.

How PCI-DSS Protects Businesses

PCI-DSS plays a pivotal role by setting stringent security measures that protect sensitive cardholder data.

Prevention of data breaches

By complying with PCI-DSS standards, businesses can dramatically reduce the incidence of data breaches. The robust security requirements sideline the potential weaknesses in systems that can be exploited by cybercriminals.

Protection against fraud

PCI-DSS standards provide a systematic and layered protection approach to combat payment card fraud. Compliance demands regular security audits, vulnerability assessments, and intrusion detection to ensure the highest levels of security.

Enhanced consumer confidence

When businesses adhere to PCI-DSS standards, they broadcast to their consumers a clear dedication to security. This message of commitment not only enhances customer confidence but promotes customer loyalty.

The Process of Becoming PCI-DSS Compliant

Achieving PCI-DSS compliance requires a holistic approach to security, involving an assessment of current processes, remediation of vulnerabilities, and regular reporting.

Assessment of current business processes

The first step involves an assessment of a company’s current payment card processing environment. This includes identifying all points where cardholder data is stored, processed, or transmitted.

Remediation of security vulnerabilities

Based on the initial assessment, security weaknesses are identified and must be rectified. The remediation process might involve updating software, altering business processes, or implementing new security measures.

Reporting to banking partners and card schemes

Businesses are required to regularly report on the status of their PCI-DSS compliance to their acquiring banks. This includes the submission of required validation documents, such as annual Self-Assessment Questionnaires or Reports on Compliance.

The Role of the PCI-DSS Self-Assessment Questionnaire

The Self-Assessment Questionnaire (SAQ) is a significant component of PCI-DSS compliance, used to validate the compliance of merchants and service providers.

Understanding the PCI SAQ

The PCI SAQ is a validation tool intended to assist merchants and service providers self-evaluate their PCI-DSS compliance. It comprises a series of yes-or-no questions about the security practices in place.

How to determine your SAQ type

Different types of businesses require different SAQ types, which depends on how a business handles cardholder data. For example, an e-commerce business will need a different SAQ from a brick-and-mortar store.

Filling the SAQ form and achieving compliance

Once the correct SAQ type has been identified, the merchant must fill out the questionnaire and work towards meeting all the requirements. It’s recommended the businesses seek professional advice to ensure correct compliance processes.

The Cost of PCI-DSS Compliance

While compliance incurs cost, non-compliance can lead to greater financial losses in the long run.

Investments in security systems

Depending on the size and nature of a business, the complexity of its payment card processes, initial investment can vary. It may include purchase, installation and maintenance of firewalls, encryption services, intrusion-detection systems, and secure software.

Training of employees

Training costs to ensure employees are aware of their roles in maintaining a secure environment strongly impact the total cost of PCI-DSS compliance. It includes training on secure protocols, data management, and threat awareness.

Ongoing compliance costs

Apart from the one-time expenses, there are also ongoing costs associated with maintaining compliance, such as regular system audits, network testing, and process evaluations.

Overcoming Challenges in PCI-DSS Compliance

Despite the stringent requirements, businesses can overcome the challenges of achieving and maintaining PCI-DSS compliance with a methodical approach.

Dealing with lack of awareness

Lack of awareness about the importance of PCI-DSS compliance can be a major hindrance to achieving and maintaining compliance. Businesses must educate all relevant staff about the importance of PCI-DSS and the potential repercussions of non-compliance.

Managing technical complexities

The technical complexities involved with PCI-DSS compliance can be overwhelming. Proper understanding and interpretation of the requirements can help, along with seeking assistance from professionals trained in PCI-DSS compliance.

Addressing resource limitations

Many small businesses struggle to allocate the necessary resources to ensure compliance. However, outsourcing payment card processing to third-party vendors or integrating compliant payment solutions can help overcome these limitations.

The Evolution of PCI-DSS Standards in Business

As technology trends change and cybersecurity threats evolve, so too have the PCI-DSS standards.

The expansion of digital payments

The growth in digital payments has made PCI-DSS compliance more critical than ever. Businesses now must ensure secure storage, processing, and transmission of cardholder data in digital platforms apart from traditional card-present transactions.

Need for updated security measures

With the advances in digital technology and increasing sophistication of cyber threats, there’s a need for enhancements to PCI-DSS standards. Updates to the standards are continual to respond to emerging threats while providing businesses with the guidelines to secure their payment card processes.

Implications of changes in PCI-DSS standards for businesses

While adaptations to security protocols may require an initial investment of time and resources, the overarching aim of these changes is to protect businesses and their customers from harm. Keeping step with current PCI-DSS standards is key to maintaining a resilient and trustworthy business.

The Future of PCI-DSS Compliance

PCI-DSS will continue to be crucial as we step further into an era of digital transactions.

Increasing necessity in an expanding digital marketplace

The expanding digital marketplace brings with it the increase in associated risks, making PCI-DSS compliance more vital than ever. As more businesses transition online, adhering to these standards will become mandatory for survival in the digital realm.

New innovations in secure payment technologies

The introduction of new payment technologies and solutions will also affect PCI-DSS protocols, requiring ongoing adaptations and updates. This continual evolution keeps the standards relevant and effective in tackling new security challenges.

Predictions for future modifications of PCI-DSS standards

As cyber threats continue to evolve, so too will PCI-DSS standards. We can expect future modifications to delve deeper into end-to-end encryption, multi-factor authentication, and more rigorous monitoring of network resources, all aiming for heightened data protection.

[…] many small businesses, achieving PCI-DSS compliance means investing in new technology. This might include purchasing encrypted card readers or payment […]

[…] importance of PCI-DSS cannot be overstated. It represents a common shared ground to protect sensitive payment card data, […]